During my time as an economics major, I learned a vast amount of information about different economic variables and data points and the interplay between them. But there’s one thing that wasn’t part of my education, and that’s the concept of “negative interest rate.” Why? Because they’re something that, ideally, should never happen.

A negative interest rate is a monetary policy that’s implemented to mitigate a financial crisis. It’s an extremely unconventional tool that’s employed by a central bank. The bank sets nominal target interest rates with a negative value – or below the lower bound of 0%. The concept of a negative interest rate was developed in the 1990s.

In this scenario, cash deposits incur a charge for storage at a bank rather than receiving interest income. Depositors must pay to keep their money with the bank. The idea behind this economic environment is to incentivize banks to lend money more freely.

Looking around in the financial world we live in, 10-year bond yields in the US have dropped like a rock. They currently hover at right about 1.7%

But here’s where it gets somewhat crazy – Australia’s 10-year yield at less than 1%. The United Kingdom’s is at less than 0.5%. Japan is at -22 basis points, France is at -27 basis points, and Germany is at -.58%.

(Remember, basis points are a measure for describing the percentage change in a financial instrument. Here, the instrument is the bond market.)

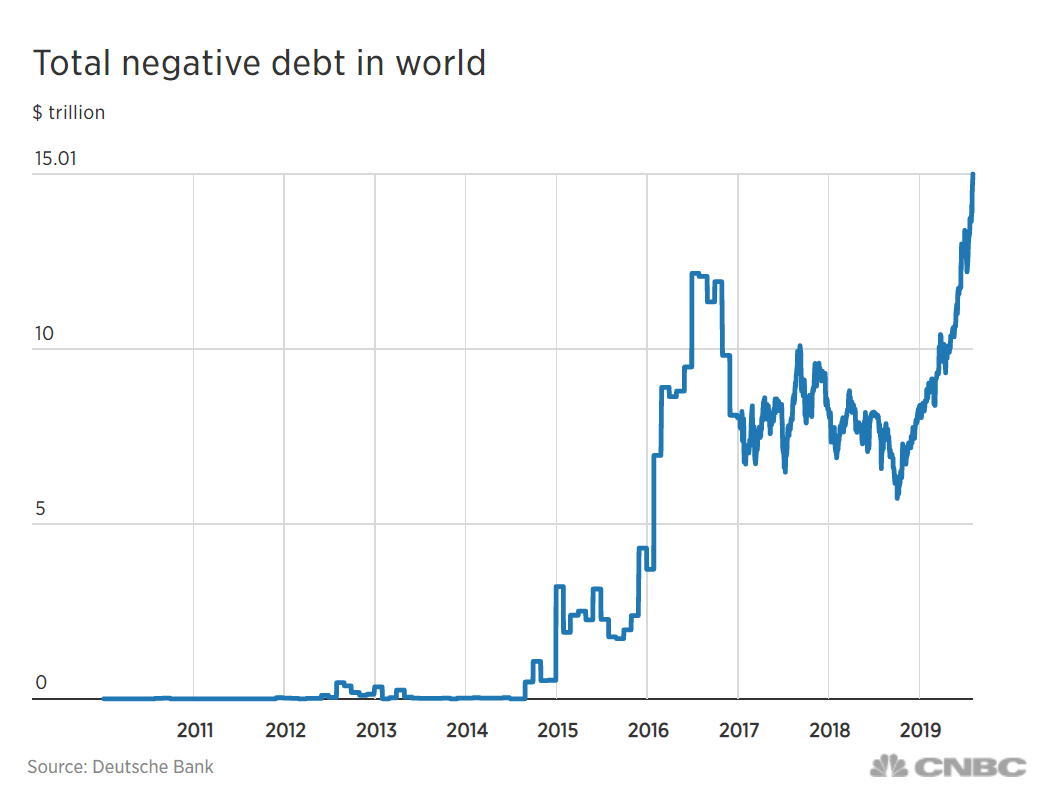

According to Deutsche Bank, about $15 trillion of government bonds across the globe are now trading at negative yields.

Let’s talk about the practical implications of negative interest rates.

In a scenario where interest rates are negative, and you deposit money into a bank, you pay the bank to hold your money (instead of the bank paying you interest)!

As for bond yields, remember that bonds are in essence IOUs. You pay for a government bond for a set duration of time (like 10 years), and the idea is that at the end of the term, you get your money back plus interest. The interest is typically in the 1, 2, 3 or 5% per year realm.

But in the case of bonds with a negative interest yield, you pay a price that’s more than the interest you would receive. So, at the end of the term, you only get “most” of your money back.

Say, for example, that you buy a one-year bond at -1% interest, and you pay $10,000 for the bond. Once the bond matures, you would get back $9,900. So, 99% versus the 105% or 110% that would happen in a “normal” environment.

I know what’s on your mind: “Why would this be happening?”

Historically, people would give the government their money – instead of spending it – with the promise of being paid back over time with interest. Now, governments are effectively getting paid to borrow money as people become increasingly desperate for a haven for their wealth.

Take a look at this chart of the total negative debt in the world from CNBC:

Currently, a bank in Denmark is offering borrowers mortgages at a negative interest rate; they are paying customers to borrow money for a house purchase. According to Business Insider, Jyske Bank, Denmark’s third-largest bank, said this week that customers can now take out a 10-year fixed-rate mortgage with an interest rate of -0.5%. This means that these customers will pay back less than the amount they borrowed.

To put the -0.5% rate in context, let’s say you bought a house for $1 million. You paid off your mortgage in full during the ten years. All told, you would have paid the bank back only $995,000.

The negative interest rate from Jyske Bank’s is just the most recent in a sequence of rock-bottom interest offers from banks to Danish homeowners-to-be.

“It’s never been cheaper to borrow,” says Lise Nytoft Bergmann, the chief analyst at Nordea’s home finance unit in Denmark, in an interview with Bloomberg.

Negative rates have been available on short-term mortgage bonds in Denmark since May, but have only recently been made directly available to consumers.

In the same Bloomberg report, it was noted that some Danish lenders were offering 30-year mortgages at a 0.5% rate. According to The Local, a Danish news outlet, Nordea Bank, Scandinavia’s biggest lender, has stated it will soon offer a 20-year fixed-rate mortgage with 0% interest.

Here’s our bottom line, folks. This environment is bizarre. Clearly, there is substantial fear of a global slowdown, and banks are doing all they can to keep their money “safe.” All they seem to be concerned with at the moment, with interest rates as they are, is that they get their money (or at least most of it) back.

These moves have created a slippery slope. Investors could take the current environment to an extreme and accept less out of fear, just to get back “most” of their capital. This trend will likely continue until the global economy sees significant synchronized growth. And, it will take central banks like the Federal Reserve and the European Central Bank to slowly begin to start raising rates without worrying about significant economic impact.

While low rates will undoubtedly last for a while, they won’t last forever.