Forget having a finger on the pulse of the US economy. Trump has an adrenaline bag hooked right into the market’s veins. And he uses it, dripping and tapering, controlling just how the stock market performs.

This bag of juice comes straight from President Trump’s trade talks. He’s been leveraging negotiations to create an on-command economic hot streak for some time now. This cause-and-effect relationship is something we’ve never seen in the history of the American stock market.

Trump is in a fantastic place. While regulating the stock market via trade negotiations, he’s extended his strategy. The extended Phase 2 of talks could lead to more phases still – and even more opportunities for adrenaline rushes.

His adrenaline drip is a tremendous asset, especially now. Not only is the entire presidential cycle powerful for the market (with third and fourth years being the most critical), it is particularly powerful for first-term presidents. And what do first-term commanders-in-chief want at the end of a good run? One word – reelection.

This prospect is likely what’s driving Trump, who I believe is the most stock market-oriented president of all time.

Now, I know that President Trump has sent out tweets that he doesn’t really watch the stock market. I’m not buying it.

Recently at the White House, he hosted Louisiana State University’s champion Tigers. Taking the podium, with the players standing in a huddle behind him, his first line was: “Stock market – all-time high today.”

Trump cares about stocks. And he has massive influence over them.

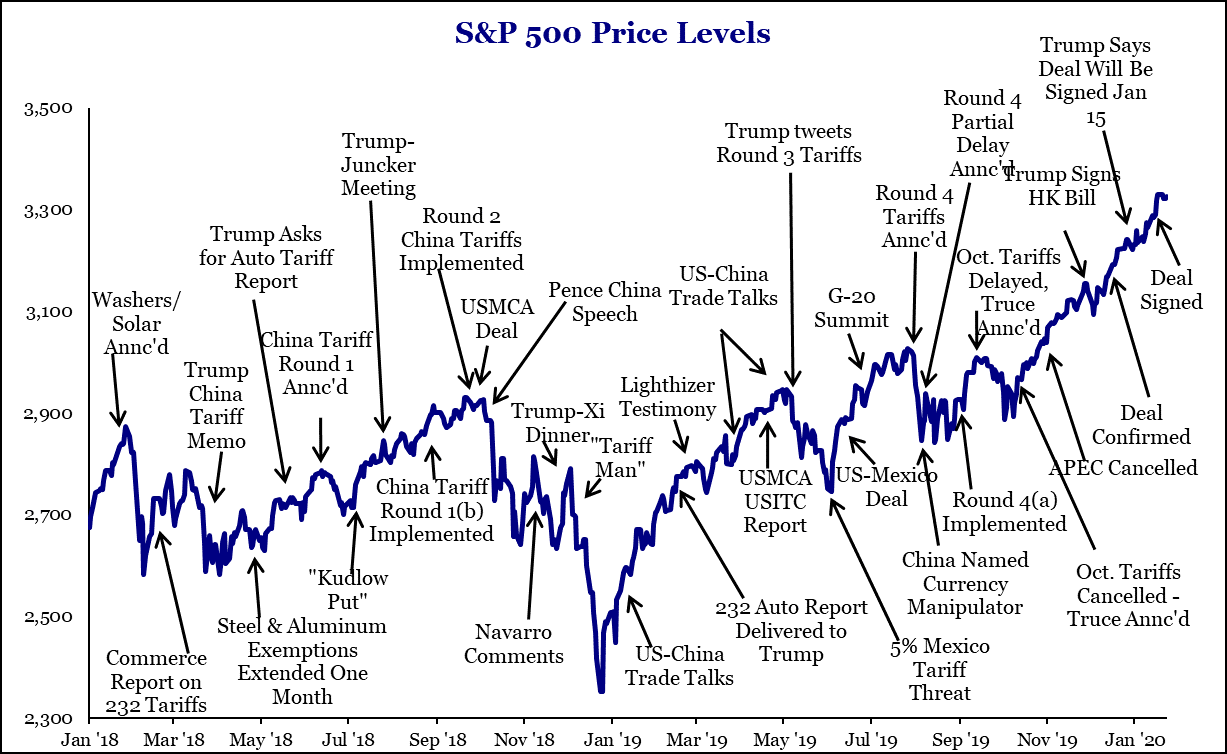

Think about the impact that trade progress – the positive developments between the US and China’s talks – has had on stocks. The relationship is uncanny. There’s no denying that we’ve had significant gains. In 2019, the S&P 500 was up 30%.

With hindsight as our friend, let’s look at that relationship in 2019. With trade talks going well, we get a shot of adrenaline and markets go up. When trade talks come to a stall (meaning Trump says, “We don’t even want a deal”), the adrenaline dip gets cut off, and markets head back down.

There’s no overstating how incredible this relationship was to watch. Take a look at this chart. It plots trade headlines – mostly those initiated by Trump and the White House – alongside the peaks and valleys of the S&P 500. The relationship is uncanny.

Chart: Strategas

As you can see, the IV drip really got its start in 2018.

During April through June of 2018, the steel tariff exemptions extended while markets were rising. Then, during a peak, Chinese tariff Round 1 happened. Wham. The market immediately sold off between 3% to 5%.

In July, as the market is struggling, Larry Kudlow, Trump’s Director of the National Economic Council, says he thinks we’ll be able to strike a deal with China. Trump meets with Jean-Claude Juncker, President of the European Commission, and commits that we won’t impose auto tariffs on the EU. Juice from the bag, and up goes the market in response to this news.

Then in September, we get another peak. Trump rolled out China tariffs Round 2. He didn’t do so until the market was at yet another peak. This move gave investors some cushion.

Now, in late September through December, we were in a bear market. The trade rhetoric was elevating and getting more hard line. Vice President Pence said in a speech about the trade war, “I am a tariff man.” This was a blow to the stock market, but perhaps a necessary one in light of what happened next.

Early January of 2019, Trump tweeted from Beijing, “Talks with China are going very well!” Such was the beginning of a 90-day trade truce and a full shot of the good stuff. After this news, the market went up and up; it gave Trump even more currency to work with.

And then, on May 10th, 2019, the Trump-market IV adrenaline drip is cut off. On that day, Trump increased tariffs on $200 billion worth of Chinese goods. The hike was more of a spike, going from 10% to 25%. Again, the market craters.

Enter Larry Kudlow again. He says the president wants to make a deal, infusing more energy to the market as we watch it climb back up. During this peak, Trump announces that the US doesn’t need a deal – China does. Even more adrenaline from the bag as markets climb higher.

Hence, Trump’s tap on the adrenaline bag. When trade talks stall, we feel it. And when the US and China are at the negotiation table, markets react in a big way. There’s no exaggerating this correlation.

Now, we’re moving on to Phase 2. With the Phase 1 agreement in place – signed by Trump and Vice Premier Liu He, China’s top negotiator – Kudlow shows up again and says that Phase 2 begins immediately. In his talk on CNBC, I think he said it no less than 18 times. He was driving the message home.

With the adrenaline from Phase 1 nearly dried up, Phase 2 is bringing a fresh bag to the table.

This likely isn’t the end of the Trump-market relationship, my friends. As Steven Mnuchin, the US Secretary of the Treasury, said during a panel at the World Economic Forum at Davos: there may be a Phase 2 A, Phase 2 B, and even a Phase 2 C! He went on to indicate that it doesn’t need to be a big bang, and we’ll take tariffs all along the way.

We could be looking at three more full IV bags of the good stuff for our president to drip into the market as he sees fit.

Will it work this time? We don’t know for sure yet. We have the benefit of hindsight now. What we do know is that a full trade deal with China would spur tremendous economic growth for both sides of the table. I believe it would be a boon for US companies. The past two years have shown the US economy responds well when we’re on the road to a deal. Striking one would likely pump the market even more.

And now, we’ve reached our bottom line. The third-year hope for reelection and the leveraging of a China trade deal have turned out to be a powerful force in 2019 on the US stock market. Looking towards 2020, we could see more of the same.

We’re in the fourth-year cycle, with election day on the horizon. And, we’ve entered into Phase 2 of negotiations with China – which could include separate parts, like Phase 2 A, Phase 2 B and so on. Trump’s got his trigger finger ready for some more juice. We should be careful to watch for what comes next.

What could go wrong? If we see Trump voted out this coming November, the adrenaline bag would likely go with him. So, the market would have to find something else as a rallying point. But, with the economy going strong and Trump controlling the market, I think the odds are in his favor.