Generating Income from Stock Dividends vs. Bond Interest

If there’s ever a chart to remember as an investor it’s this one. This is not a chart that chronicles one magical stock purchase that climbed to the moon. Instead, it’s the story of an unassuming force in investing that could create a rising source of income for a lifetime. It’s the story of stock dividends, which have proven to grow at twice the rate of inflation over the better part of stock market history. The following study will also compare how an investment in equities for dividend income has fared relative to investing in bonds for income, which is commonly thought of as a more conservative counterpart to stocks.

The Study

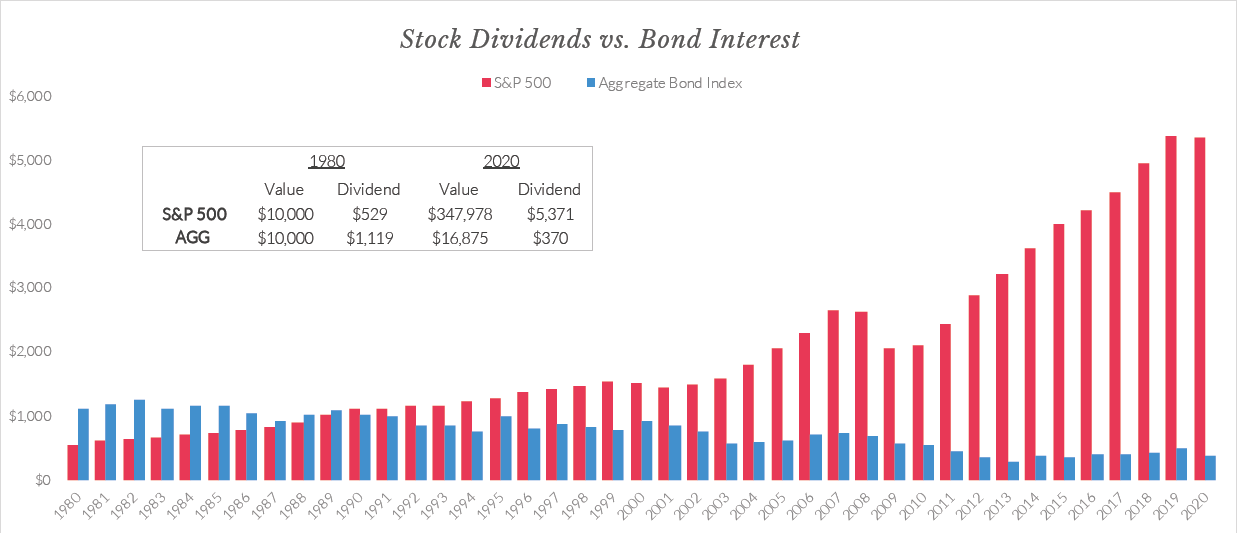

Let’s compare a $10,000 investment in the S&P 500 vs. the Aggregate Bond Index beginning in 1980. In each case, the investor left the principle alone, while taking the income produced each year to spend. The income from stock dividends is shown in red, income from bonds (interest) is shown in blue.

Source: Capital Investment Advisors

First, we’ll talk about the red line – stock dividends.

As you can see in the table above, in the very first year, a $10,000 investment in the S&P 500 paid a dividend of about $529 in year one or 5.3 percent on the initial investment. Forty years later, the dividend income shown by the red line climbed to about $5,371. That’s a near 54 percent annual yield on the original investment.

This shows that the income from stock dividends grew at about 6 percent per year. Inflation during that same period grew at about 3 percent. So, dividends increased at double the rate of inflation. Talk about protecting your purchasing power.

But don’t forget that the investment corpus grew as well. In addition to the income you received each year, your $10,000 investment would have grown into more than $347,000.

This price-only return (which excludes dividend income) clocks in at about 9 percent per year. If you add in another 3 percent for the dividends each year, you get a total return of about 12 percent per year. If you had reinvested all the dividends into your portfolio, your $10,000 would have grown to more than $1,000,000 after 40 years.

What about the blue line – bond interest?

Bonds are typically thought of as a safer alternative to stocks — maybe too safe. They were great in 1980 when you were getting an 11 percent return. But over time, the Lehman/Barclay’s aggregate bond index grew from $10,000 to only $16,875 and only paid you $370 in 2020, or 2.2 percent on your investment.

The Verdict

Stock dividend income wins against bond income by an incredibly large margin. Annual stock dividend income increased over 10-fold, while the remaining price-only return grew 35-fold. Bonds on the other hand, rose less than two times in price, with a 67 percent reduction in income. And this is the longest bond bull market we’ve seen in history.

It doesn’t matter if you have $500,000, $5 million, or $50 million in your retirement portfolio. It’s hard to find a more consistent source of growing income to outpace inflation, along with the potential for a dramatic increase in your underlying principle. 35X the value of your investment, and 10X your annual *income.

When you look at these historical studies you might say to yourself, “That would have been nice over the last 40 years, so haven’t I missed the boat?” Not really. If you’re 40 or 50 years old, don’t you have 3 to 4 decades left to invest? Contrary to your brain saying, “it’s too late for this” remember that you have more years of spending ahead of you than you might think. Think in decades, not years.

Now, imagine looking specifically for stocks that are perennial dividend payers and consistent dividend growers. This pursuit of dividends is perhaps worthy of a life’s work for any investor, with the long-term patience and vision to do so.

*From 1980 through 2020 this study showed that cumulatively, bond interested totaled $31,150 while stock dividends totaled $82,433. From a current income standpoint, by 2020, stock dividends were more than 14.5 times that of bond interest per year ($5,371 vs. $370). For Bond interest, we took the yield to worst for the end of the previous year on Bloomberg Barclay’s Aggregate bond index, multiplied by the starting value for the year.

This article has been updated as of 4/16/2021.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. Investment decisions should not be made solely based on information contained in this article. The information contained in the article is strictly an opinion and for informational purposes only and it is not known whether the strategies will be successful. There are many aspects and criteria that must be examined and considered before investing.

1 Comment