Interest rate increases and inflation have dominated the news in recent memory. From mortgage rates to the price of tacos, almost everything has seemingly gone in one direction: up. However, when it comes to marriage the opposite appears to be true. According to a Pew Research Study, the U.S. has seen a significant decline in marriage and partners over the last three decades.

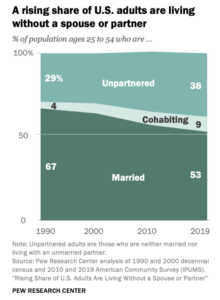

In 1990, 67 percent of Americans between the ages of twenty-five and fifty-four were married. By 2019, that rate sat at 53 percent. The percentage of unpartnered folks jumped from 19 to 38 percent in that same period, with “unpartnered” defined as adults who are neither married nor living with an unmarried partner. Interestingly, we did see more people cohabitating outside of marriage or partnerships — an uptick from 4 to 9 percent in this span.

Many Hands Make Light Work

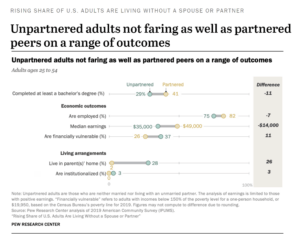

For the most part, married or partnered folks appeared to find themselves on a better career track and more financially sound than those who weren’t. Married or partnered couples are more educated, make more money and are less financially vulnerable according to the research.

Growing up, I remember my mom looking up from a sink full of dirty dishes and saying, “Many hands make light work.” In other words, if I or one of my four siblings got stuck doing the chore alone, cleaning up a big meal might take an hour. On the other hand, if we combined efforts, the job only took fifteen minutes. Of course, this was before we had an actual dishwasher, but you get the point.

The same concept seems to apply to the dynamic between marriage/partnership and money. The Pew study showed 82 percent of those partnered being employed, compared to only 75 percent of unpartnered. In 2019, the median earnings of the unpartnered came in at $35,000 annually, while those partnered rose to $49,000 — a $14,000 difference. Thirty-seven percent of unpartnered folks were reportedly financially vulnerable, while that fell to 26 percent for those who had “teamed up” in life.

Living That Bachelor Life

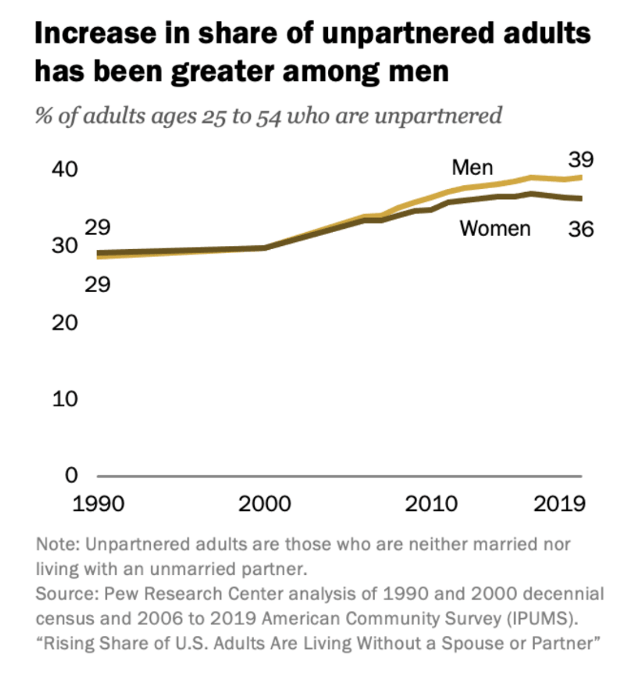

The trend of getting married later or not at all was slightly more pronounced among men, rising from 29 percent in 1990 to 39 percent in 2019. Those numbers for women were 29 and 36 percent, respectively.

Financial Challenges of the Single Life

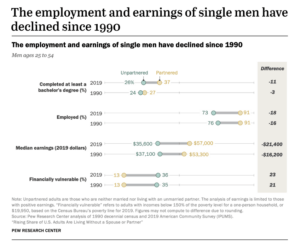

Comparing median earnings for partnered vs. unpartnered men showed that when adjusted for inflation, single men earned less in 2019 than in 1990, whereas the opposite was true for partnered men. That tells us that, for whatever reason, being single became more financially tricky from 1990 to 2019.

Bottom Line

Logically, one can imagine why joining forces with a teammate creates financial momentum. Remember those wise words of my mom — many hands make light work. And so, as the trend of marrying or partnering continued to decline in the U.S., the data suggested further financial challenges ahead for those flying solo. It seems authors Thomas Stanley and Bill Danko were right when they said one of the secrets of the millionaires next door was to be, and stay, married!

The research my team and I did for my book, You Can Retire Sooner Than You Think, returned similar conclusions. There’s no way around it: marriage is more economically efficient and cost-effective. It may not sound romantic, but a marriage or partnership creates economies of scale. If you have two people adding money to a retirement fund, it should grow faster. This math is why so many of the happiest retirees on the block, the HROBs, aren’t single.

As always, statistics don’t speak for everyone. If you enjoy a blissful solitary life, more power to you. I won’t deny a tiny yearning for a taste of that quietude when I want to watch the UGA football game, and my wife doesn’t. And you can bet she has many examples of me cramping her style. But as a general trend, financial success appears easier to achieve with a spouse or partner. Those looking to increase their odds might consider falling in love. It worked for me.

If you’re reading this and thinking that planning for a happy retirement sounds overwhelming, it certainly can be! But it doesn’t have to. I will tell you from personal experience that having a partner in that journey helps a lot. We all want our marriage or partnership to be about love. But that doesn’t mean you can’t also celebrate the opportunity for two incomes. After all, is anything more romantic than working together to build a happy future?

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.