President Trump made some serious waves at a recent NATO meeting in Brussels. There has been a lot of buzz in the news about what happened at the summit, primarily about the President pressing other NATO member nations to step up their defense spending. I want to review the current state of affairs, dig into what Trump called for, and analyze the potential economic benefits.

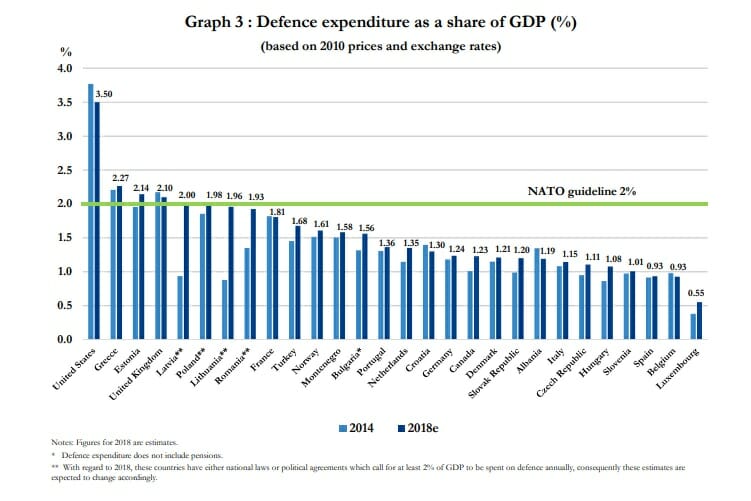

Let’s start with a quick primer. North Atlantic Treaty Organization members have long been expected to devote 2% of their GDP to defense spending. But only six of the current 29 members states currently meet that threshold: the U.S. at 3.6%, Greece at 2.2%, Estonia at 2.14%, the UK at 2.10%, and Romania and Poland both at 2%. And if we consider the relative size of these countries’ GDPs, the only truly impactful contributions come from the US and the UK.

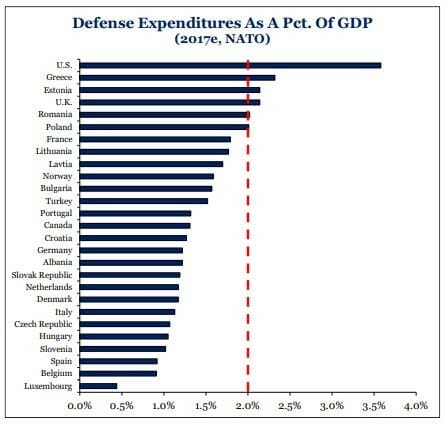

What are the other countries contributing? Take a look at the chart below for illustration. You’ll see that last year, France, Norway, Canada, Italy, the Netherlands, Croatia, Portugal, Bulgaria, and Germany are all well under the 2% mark. As for Spain, Belgium and Luxembourg, they spent under 1%.

Chart from Nato.int

Now, consider the fascinating example of Germany. This country is chugging along with the world’s fourth-largest economy. Want to guess how it’s military is doing? If you said, “Pretty darn poor,” you’d be dead on. Of this nation’s 128 Typhoon fighter jets, only four (four!) are combat ready. None of Germany’s half-dozen submarines are at sea. Of 244 combat tanks, only 95 are operational.

This is but one example, but it illustrates why President Trump takes such serious issue with the global state of defense. So, he wants to see two major changes in the way the NATO players have been spending (or not spending) to keep us all safe.

First, he wants every single member to step up to the 2% of GDP level of contributions now, as opposed to in 2024, which was the original agreement. And second, Trump wants the target for spending to jump to 4% of every NATO countries’ GDP, double the current requirement.

Wow and wow. This would represent a tremendous increase in global defense spending if all 29 nations stepped up and hit the 4% mark.

This position could definitely mean an about-face from the conversation we’ve been having regarding defense stocks over the past couple of years. To date, the lack of required spending has been one of the most interesting economic (and political) disconnects. Maybe Trump’s call to action will change the dialogue?

NATO countries currently spend a combined $1.0 trillion on defense each year, of which $700 billion comes from the US. So, if everyone just started meeting the 2% threshold, we’d see an increase in defense spending of about $110 billion. And if the bar were raised to 4%, we’d see a behemoth shift in spending to about $1.5 trillion.

(You may be wondering why our $1.0 trillion figure wouldn’t double. That’s because the U.S. is already so close to the 4% mark, coming in at 3.5% of GDP.)

There has been extraordinary push back on Trump’s demands. Germany argues that all of its defense spending is heavily focused on supporting NATO and that the 2% mark isn’t the right measure. Canada concurs. Despite such grousing, the likely prevailing direction is higher defense spending around the globe.

That growth could be excellent news for the U.S. and international defense stocks. Global spending on weapons and military services totaled $374.8 billion in 2016. U.S. companies grabbed almost 60% of that pie — $217.4 billion. Seven of the world’s largest arms-makers are US companies: Lockheed-Martin, Boeing, Raytheon, Northrup Grumman, General Dynamics, and L3. The other three are Britain’s BAE Systems, Italian aerospace giant Leonardo, and Airbus, which is British-French-owned.

I was not surprised by President Trump’s very public call for NATO countries to honor their commitment to spend at least 2% of GDP on military and defense. But what I didn’t expect was the call for that number to double. I think the 4% is a stretch for most of these countries. But I also think the prevailing trend for spending in this already massive sector could be headed higher. As a result, the defense sector may be poised for serious growth.