Sometimes it takes stamina and resilience to be one of the happiest retirees on the block. It also pays to stay calm when the world as we know it turns upside down. My neighbor, who I’ll call Reactive Ralph, made a major financial mistake in 2020. When the economic shutdown resulted in the fastest 30% market drop in history, Ralph panicked and liquidated all his stock holdings for cash to get through it all. He figured he’d make up for it later. In fact, Ralph took a 35 percent loss from which he may never recover. What differentiates the people who scrambled to stay afloat and those whose retirement accounts remain intact?

You’ve heard the saying, “Don’t put all your eggs in one basket?” Well, this holds true for your retirement portfolio. I coach my clients not to think about their retirement portfolios as potential piggy banks to raid during hard times. Instead, if you build the right allocation of investments that includes easy access to sources of cash reserves, you essentially Own Your Expense Powder or O’YEP. This puts you in control of your finances and helps you withstand market corrections.

To be able to say, “O’YEP, I’ve got this,” you’ll need to plan ahead for the next financial crisis. Yes, there’s bound to be another one. Maybe not as harsh as what we experienced in 2020 (the only declines as steep as that were seen during the Great Depression and again on “Black Monday” in 1987), but it will happen. I encourage you to use the Great Reopening as a time to prepare, so you can weather the next tsunami.

Building on the Basics of O’YEP

Let’s take a deeper dive into the four keys to O’YEP – diversifying your investments, building up your “dry powder,” understanding the history of market corrections, and determining your “expense powder.”

Building O’YEP is pretty straightforward, and it starts with income investing. Our core investment philosophy at Capital Investment Advisors focuses on allocating your assets into four “buckets” – Cash, Income, Growth, and Alternative – so they generate consistent cash flow from dividends (Growth bucket), interest (Income bucket), and distributions (Alternative bucket).

Next, you want to add some dry powder to the mix. Historically, this refers to the necessity of using dry (not damp) gunpowder in weapons. In finance, it means the cash reserves a company or individual maintains to meet obligations in times of economic stress. At Capital Investment Advisors, dry powder equates to the various ways to fill your Cash (savings, money market, CDs) and Income (treasuries, municipal, investment-grade bonds) buckets.

History Repeating Itself

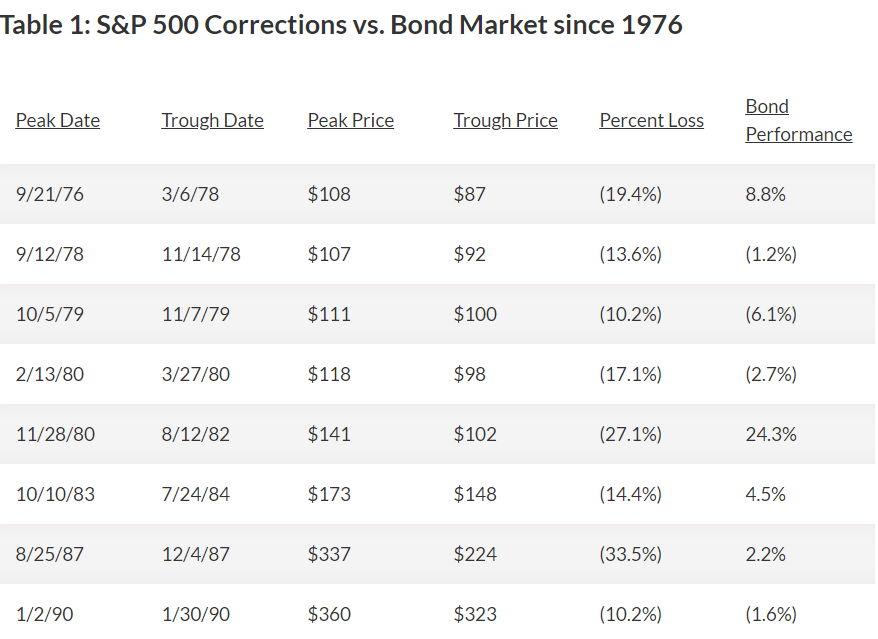

Now that we understand how to build O’YEP, let’s look at why you should. If we examine the history of the stock market, we see that during the past 90 years the market averages a correction of 10% or more every 1.7 years. Major corrections (aka Bear Markets) of 20% or more occur once every 4.5 years. The tables below show the magnitude of past market corrections and the length of market recoveries.

Source: Yardeni Research, Inc., Bloomberg

From Table 1 you can see that during the past 45 years there have been 22 market pullbacks of 10% or more. That’s an average of one correction every 2.6 years. Major corrections (aka Bear Markets) when the market corrects 20% or more are much less common – there have been five since 1976. Average that out, and we’ve had a Bear Market occur once every nine years (if you include the 19% pullbacks, the occurrence is once every 4.5 years).

Here’s how the S&P 500 compared to the bond market (Bloomberg Barclays Aggregate Bond Index) during this same period:

All corrections:

- Average of S&P: -20.6%

- Average of Bond market: +3.7%

Corrections with recession:

- Average of S&P: -34.0%

- Average of Bond market: +9.5%

Corrections without recession:

- Average of S&P: -15.6%

- Average of Bond market: +1.5%

As you can see, the S&P 500 and bond market are not highly correlated. Meaning, when the stock market drops, bonds (and cash) stay relatively flat to up by comparison.

O’YEP Prime Principle: If you need cash during a correction, it’s better to sell an asset that is either up in value or flat, not an asset that is significantly down in price.

O’YEP Prime Principle: If you need cash during a correction, it’s better to sell an asset that is either up in value or flat, not an asset that is significantly down in price.

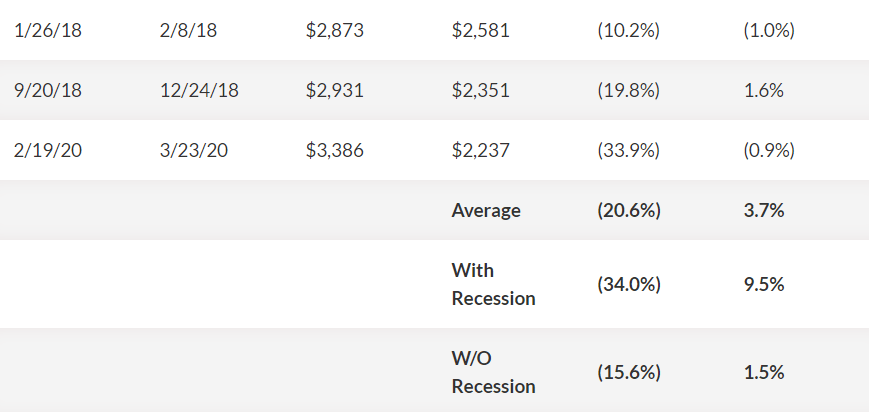

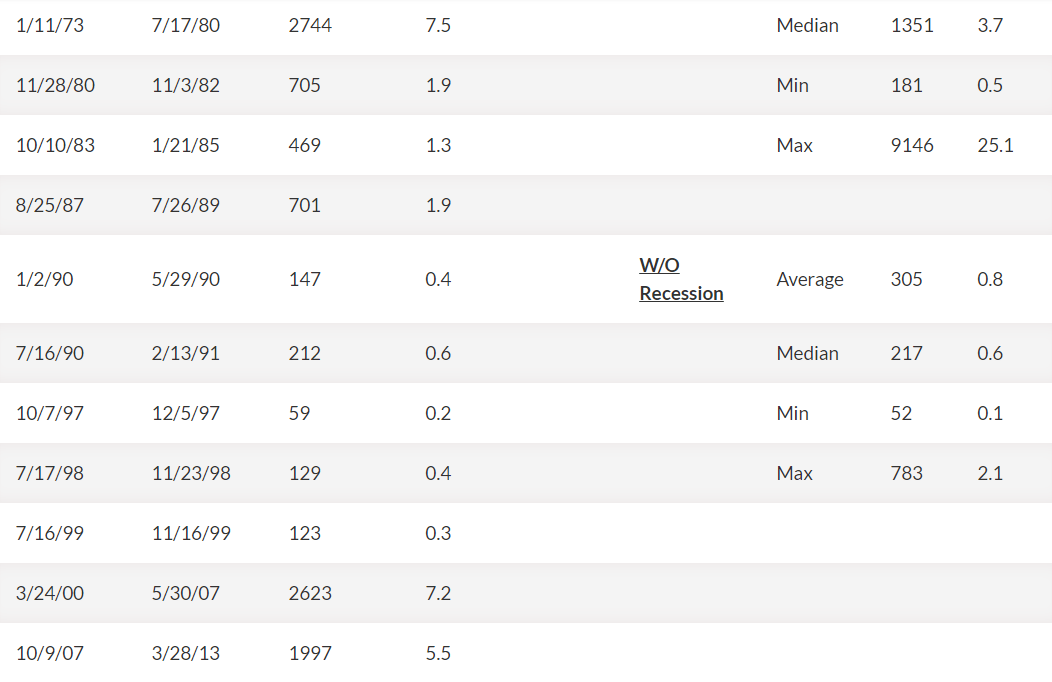

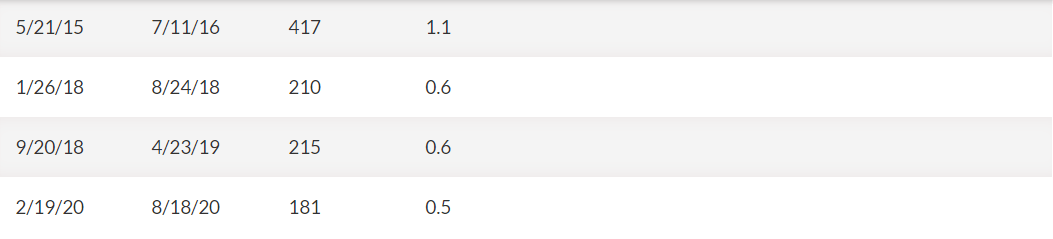

But determining how much cash you’ll need depends on how long it will take for the market to get back to even or higher. Some more historical data can help us with that:

Source: Yardeni Research, Inc., Bloomberg

In Table 2 we see that recession corrections take about 6.2 years to recover. If we exclude the Great Depression, we see an average of 3.8 years to fully recover, with a median of 1.9 years. Non-recession corrections (such as COVID-19) take less than a year to recover. So, when you’re retired and the market corrects, you want to hold enough in bonds and cash to get through the recovery period. This is what we call your Expense Powder (EP).

![]() O’YEP Prime Principle: If the average correction recovery takes between two to four years, you might consider owning that same amount of EP between your Cash and Income buckets. That way, you can use it to get you through to the next market downturn, while your Growth and Alternative buckets recover.

O’YEP Prime Principle: If the average correction recovery takes between two to four years, you might consider owning that same amount of EP between your Cash and Income buckets. That way, you can use it to get you through to the next market downturn, while your Growth and Alternative buckets recover.

Here’s how to determine your EP:

Expense Powder (EP) = Expenses (E) – [Non-Portfolio Income (NPI) + Portfolio Income (PI)]

- Expenses are your annual living expenses for food, home, auto, medical, charitable, travel and core pursuits (those hobbies on steroids I’m always talking about.)

- NPI includes annual income from benefits such as social security, pensions, annuities, rental properties, deferred compensation, etc…

- PI is the annual cash flow generated by your Income Investing buckets (dividends, interest and distributions).

O’YEP = Expense Powder (EP) x Years to Recover

Of course, these numbers are subjective and specific to you, your unique set of circumstances and your risk tolerance.

Putting O’YEP to Work for You

If your EP is a negative number, that’s great! It means your total annual income is greater than your total annual expense. You shouldn’t have to sell a single holding in your portfolio during a correction, regardless of the recovery time, provided that your portfolio is generating consistent cash flow. This is the investment equivalent of “sitting in the catbird seat.”

If your EP is positive, read on. This is normal. I have several clients who need more to live on than their combined portfolio and non-portfolio income. This is what O’YEP was made for! Here are two examples of O’YEP in action:

Aggressive Amy

Aggressive Amy and her husband Andy are in their early 60’s. Andy is retired. Amy plans to work for two more years. She has an annual salary of $30,000 and Andy’s social security benefit is $1,500 per month. They have a $750,000 investment portfolio which generates about $20,000 per year in dividends, interest and distributions. They spend about $10,000 per month on life (food, shelter and fun). They want their assets to grow as much as possible and are heavily invested in stocks.

If we do the math:

$120,000 (E) – [$48,000 (NPI) + $20,000 (PI)] = $52,000 EP

- Expenses: $10,000/mo. x 12 months

- Non-Portfolio Income: $30,000 salary + $1,500/mo. social security x 12 months

- Portfolio Income: $20,000

Amy and Andy might consider O’YEP = EP x 2 years in their Cash and Income buckets, which would be $104,000, or approximately 15% in O’YEP and the remaining 85% invested in their Growth and Alternative buckets.

Conservative Clark

Conservative Clark and his wife Carrie are in their mid-70’s. Both are retired and nervous about everything from the stock market to politics and COVID-19 variants. Their combined social security benefits total $39,000 per year. They spend about $8,000 per month. Collectively, they have $500,000 in their retirement nest egg which generates about $13,000 per year.

If we do the math:

$96,000 (E) – [$39,000 (NPI) + $13,000 (PI)] = $44,000 EP

Clark and Carrie want O’YEP = EP x 4 years in their Cash and Income buckets, which would be $176,000, or approximately 35% in O’YEP and 65% in their Growth and Alternative buckets.

Check Your O’YEP IQ: What do Aggressive Amy and Conservative Clark have in common? They are both prepared. Unlike Reactive Ralph, they’re much less likely to panic during market correction, because they can see the big picture and have resources available to help weather the storm.

Check Your O’YEP IQ: What do Aggressive Amy and Conservative Clark have in common? They are both prepared. Unlike Reactive Ralph, they’re much less likely to panic during market correction, because they can see the big picture and have resources available to help weather the storm.

What about O’YEP and Inflation?

Remember, your O’YEP allocation is your bridge to the next correction, so you don’t have to sell securities in your Growth and Alternative buckets at a loss, which are your long-term hedge to inflation. Think about it this way, if the prices for goods like fuel, electricity, toilet paper, hamburgers, diapers and building materials are rising, you might want to own stock in the companies that produce the products the general public continues to consume even at inflated prices. Your Cash and Income buckets help protect you from short-term loss. In other words, you wouldn’t consider holding cash and bonds for appreciation, but you might consider holding them for stability.

Bottom Line

When it comes to market corrections and the security of your retirement, you should hope for the best but plan for the worst. History dictates that we’ll go through multiple market swings during our retirement years. It’s not a question of ‘if,’ it’s simply a matter of when, how big, and how long. And as Sir Winston Churchill so eloquently said, “Those who fail to learn from history are condemned to repeat it.” So, if the fastest 30% drop in the history of the stock market last March kept you up at night, now’s the time to prepare for the future. Consider working with a trusted, qualified financial planner to discuss how to achieve your customized allocation, so you can say, “O’YEP, I’m confident in my retirement!”

1 Comment