The stock market is like a pack of wolves; always on the hunt, while ever-attuned to even a hint of danger on the wind. So, it would seem that an election would prick the market’s ears and nose. Elections, after all, can lead to change, which can lead to uncertainty. And if there is one thing the market hates with a passion, it’s uncertainty.

The 2018 mid-term election could well result in the Democrats regaining control of the House of Representatives, according to pollsters, analysts, and other assorted Washington witch doctors. That would certainly be a change from the GOP’s total control of government since President Trump’s election.

The President himself has repeatedly claimed in recent weeks that any Democratic victory at the national level would lead to tumbling stock prices.

Related: How To Weather Market Storms Using The Income Investing Strategy

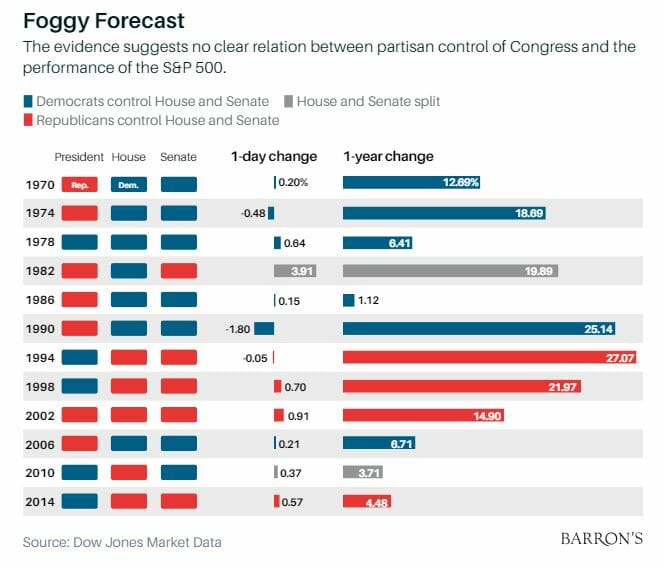

So, should you hunt for returns and sprint for the safety of the cash hills if the Dems prevail? Probably not. The fact is, oddly enough, the market pack just doesn’t get spooked by mid-term outcomes. Ten of the last 12 mid-term elections since 1970 have prompted a small day-after rally. The other three elections (1974, 1990 and 1994) were followed by one-day market dips. All 12 elections were followed by a year of market increases ranging from 1.2% (1986) to 27% (1994).

To shed a bit more historical light on this year’s contest, let’s take a look at two examples of how stocks fared in the past when the Democrats score mid-term wins while a GOP president was in office. In 2006, during George W. Bush’s second term, the Democrats took over both the House and the Senate, and both the Republic and the markets endured. The S&P 500 returned 9% over the following year. In 1986, Democrats won the Senate and held control of the House on President Ronald Reagan’s watch. Stocks returned 4% over the next year.

Related: Don’t Let Politics Cloud Your Economic Judgement

President Trump’s supporters might argue that the current situation is different; that his policies – enacted by a GOP Congress – account for much of America’s recent economic growth. A Democratic House would end all that, resulting in a historically unprecedented market tumble. And it’s true that stock growth since Trump’s inauguration has been an impressive 13.3%, annualized. But guess what? President Barack Obama’ was impressive, too: 16.3%, annualized, in the eight years from his inauguration to Trump’s.

Those numbers are close enough to allow D’s and R’s to create their own storylines. Republicans will say Trump has restored confidence, cut taxes and reduced regulation thus unleashing the mighty engine of American capitalism. Democrats could counter that Trump inherited an economy on the rise and that stocks have been soaring for a decade because of the lowest interest rates in modern history – not because of any GOP policy. There is no end to such partisan debates.

But no matter how passionate you are about your politics, do not allow your views to influence your financial choices. If you are a Republican or conservative and the Democrats win the House, do not let your disappointment metastasize into financial gloom and doom.

Related: Calculating The Value Of A Financial Advisor

If you need some reassure in case of a Democratic win, listen to the analysts at investment bank UBS. Their deep dive into the ramifications of a Democratic House boils down to this: “Eh.” The UBS experts predict a policy environment that would be net neutral for stocks. There would be lots of gridlock on Capitol Hill, marked by occasional compromises on stuff like infrastructure and drug prices. No more epic tax cuts or healthcare initiatives.

Given the market’s history with midterm elections and UBS’ glimpse of the future, I suggest investors would be wise to follow the advice of President George HW Bush: “Stay the course.”