How many times have you heard about the “seven-year itch”? Or the first year of marriage as the “honeymoon phase”? How about a mid-life crisis, or finding love later in life? How often are these (surprisingly or not) impacted by money? To find out about the relationship between money and marital happiness, I embarked on a nationwide study chronicling this very thing. And the results are fascinating.

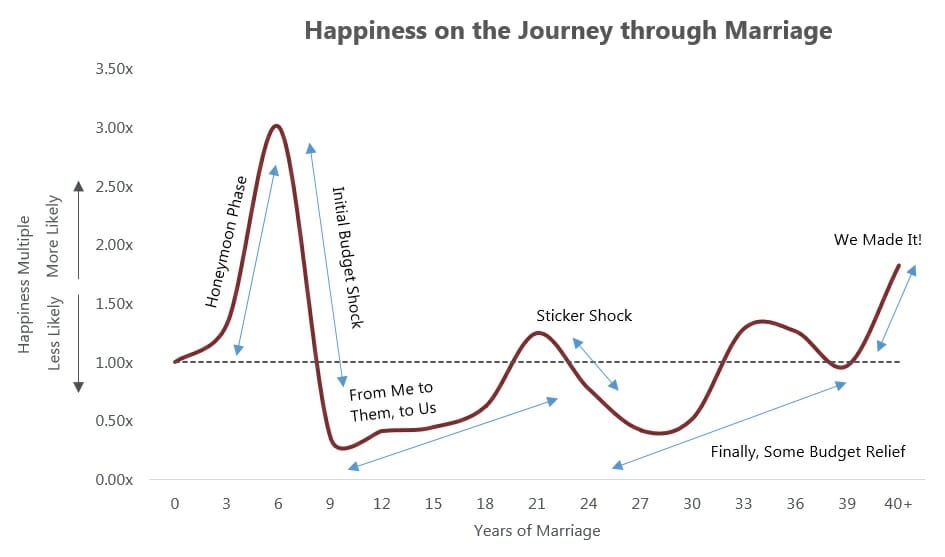

Check out our phases of marital happiness in the chart below.

Of course, no one single formula for a happy marriage exists. For every rule that studies produce, there are people and relationships that defy it. But I interact with lots of couples. Many of them retired with dozens of years of marriage behind them. Our retirement planning conversations bring a fascinating bunch of truths to light in everything from happiness, money and life goals, to social and emotional experiences.

And while television and media portray long-term married couples as bored, restless and unfulfilled, I’ve found the truth to be almost completely different. Sure enough, one recent study found that couples in stable marriages (i.e. – those not ending in divorce), showed a slight decline in happiness after about five to ten years, with contentment rising again around the 20th-anniversary mark.

Of course, communication, compatibility, mental and physical health and other factors all contribute to a couple’s success. But a relationship’s vibrancy is also related to – or at least impacted – by, you guessed it, money. So much of our days are spent in pursuit of it. And a couple’s alignment on money’s purpose in their lives can shape a lifetime worth of goals and pursuits.

Recently, I surveyed nearly 1,700 retirees with a mean age of 61 years old to understand their levels of happiness. My goal was to understand the relationship between happiness and the financial realities within major stages of married life. I also wanted to map happiness trends to help prepare couples for the ebbs and flows of their financial journey. With the results, I was able to put together what I like to call the Marriage and Happiness Timeline. Take a look below to explore happiness levels and the role finances play in each phase as reported in my survey.

0 to 6 Years – The “Honeymoon” Phase

Here, today’s retirees reported that happiness levels were on the rise. Their responses suggest a profound sense of newness, fun and freedom. Many of this group’s newlyweds have real, stable income for the first time and their experiences are enhanced by flexible cash to fund interesting things. These folks also enjoy the novelty of having a special someone to adventure with.

In this phase, cash outlay is reasonable, student loan payments (which vary with income levels) remain low, budgeting is straightforward and, in many cases, that burdensome mortgage is still a ways out. Let’s not forget, the bulk of this group has no kids, which helps keep spending reigned in.

7 to 9 Years – Reeling From “Initial Budget Shock” Phase

For couples in this stage, happiness is in a free-fall and money surprises are around every corner. Kids enter the picture, meaning that cash once spent on experiences gets swallowed up by no-fun necessities. Adding to the stress of these expenses, most couples aren’t exactly swimming in savings just yet. And pushing your budget to the brink each month when you’re only buying necessities is a quick way to cause some crankiness. However, income is just starting to rise which also causes student loan payments to jump up. And that move from a 2 bedroom apartment to the house with a yard brings a sizeable mortgage. School, daycare, soccer camp! New, expenses show up daily and of course, they are all larger than expected.

Daycare costs what?!

This jogging stroller is $400?!

I used to pay only $1.50 for my school lunch!

Did you see the electric bill? Can someone please turn off the lights?!

10 to 23 Years – The “From Me to Them to Us” Phase

Here, happiness levels balloon. The couples we surveyed have finally “settled in” or have “hit their stride”. In general, the sticker shock of doing life in 21st century America fades.

Couples have wrestled through the challenges of transitioning their spending and time from “them to us”. But finally, there’s some breathing room as kid’s independence and self-sufficiency grows. And that 16-year-old neighbor who gets her pound of flesh every time she babysits? – finally replaced by your first born who watches her siblings on date night. While the small fortune once spent on diapers is still reserved for the kids, it gets put toward enjoyable and memorable experiences, like a family cruise.

As retirees reflect back on this time, many of them remember the emotional significance of this phase. Their income levels were able to support vacations and new family experiences that brought them joy in the moment and for years after.

23 to 25 Years – The Perpetual State of “Sticker Shock” Phase

For many, this is a season of plummeting happiness. At this stage, couples’ are on the threshold of empty-nesting. Relief from the angsty teen years and weekends dominated by baseball or ballet is so close that they can taste it. Yet, the budget pendulum swings back painfully, while jobs and other obligations force spouses in different directions. All this just bottoms out feelings of happiness.

It’s likely that couples in this stage are grappling with how to cover 2-3 college tuition bills and that persistent mortgage. The emotional stress of walking with adolescents in this phase of unknowns is taxing and the realities of retirement planning, cash-flow and budgeting buries even the most resilient partners. With the average annual cost of private university eclipsing $35,000, couples ask: how will we ever afford this?

25 to 39 Years – The “Finally, Some Budget Relief!” Phase

Here, we see happiness is on the rise.

At this stage, couples really do see light at the end of the tunnel – financially and otherwise. Kids are self-sufficient and off the parental payroll. The hefty college tuition payments stop and disposable income reappears. Budgets finally rewind back to “me and us”.

The sense of relief continues as careers wind down. For many who have put their heads down, grinding for decades, freedom and autonomy are waiting in the wings. This is a time where money is enjoyed, hobbies are resurrected, and passions or side-job have room to blossom. Couples may also enter into the Retirement Grey Zone here, which is that period when an individual eases into full retirement with a relaxed work schedule and less corporate pressure.

The day-to-day financial inconveniences that put relationships on the rocks are taken in stride and the outlook that the “best is yet to come” keeps couples connected, inspired and upbeat.

40+ Years – The “We Made It!” Phase

Once these couples reach 40+ years, happiness skyrockets to levels previously unseen over the course of life. A deep sense of gratitude, anticipation and joy flows. These retirees are in their 60s and 70s, enjoying little ones (without the pains of parenting toddlers!) and making experiences a core pursuit. For many, they finally feel a sense of control over their money. Not the other way around. Budgets relax, mortgages are paid off and downsizing happens – creating a cycle of freedom, autonomy, and progressively fewer financial constraints. These couples have the time and financial bandwidth to invest in the people and projects they truly care about. These investments return a sense of purpose and wholeness.

This phase is best summed up by a note from one of the retirees I surveyed:

“No longer are we planning or purchasing that week-long Disney trip. Instead, we show up for 2 days, dote on eager grandbabies and head back home to the sun.”

In reality, much of the fullness and joy potential in the major marriage phases has money implications. And while money itself won’t deliver happiness, it certainly impacts it. So recognizing what’s ahead, anticipating cash responsibilities and planning accordingly goes a long way toward creating that lifetime of fulfillment we all crave.