The late multi-millionaire John Jacob Astor IV once said, “Wealth is largely the result of habit.” This advice is spot on. Rarely does a person grow their wealth to the million-dollar mark overnight, and if you’re waiting for a $1 million windfall to come your way, please don’t hold your breath.

Joining the ranks of America’s millionaires takes hard work, patience, and, of course, saving and investing.

So, how long does it take to become a millionaire? Take a look at the list below to see. It charts how long it will take you to reach your goal if you start from zero today, and save just $500 per month. It takes into account four different rates of return.

Remember that this list doesn’t account for life events that could affect your wealth like financial emergencies or market rises or dips. What it does do is give you a guidepost for whether you’re saving enough to meet your particular nest egg goal.

- With a 4% rate of return, you’ll be a millionaire in 51 years, by 2068.

- With a 6% rate of return, you’ll be a millionaire in 40 years, by 2057.

- With an 8% rate of return, you’ll be a millionaire in 33 years, by 2050.

- With a 10% rate of return, you’ll be a millionaire in 29 years, by 2046.

It goes without saying that the sooner you start, the quicker you’ll get there. Say you begin at age 25. If you save $500 a month, assuming a 6% return rate, you’ll hit seven figures by the time you’re 65.

Feeling impatient about becoming rich? If you can swing it, put away $2,200 a month, and you’ll be a millionaire in just 20 years. And $6,000 a month? It can get you there in just 10 years.

To see a closer estimate of your timeline that includes money already saved, use this online calculator.

Remember that, through saving and investing over time, the goal is to tap into the power of compound interest. With compounding, any interest you earn then accrues interest on itself.

What matters most is that you develop a habit of saving. The easiest way to begin is to take advantage of your employer’s 401(k) plan and company match. (Free money, anyone?) Another strategy is to invest in an IRA. These are tax-deferred accounts, meaning that your investment earnings (like interest and dividends) grow tax-free until you start making withdrawals during retirement.

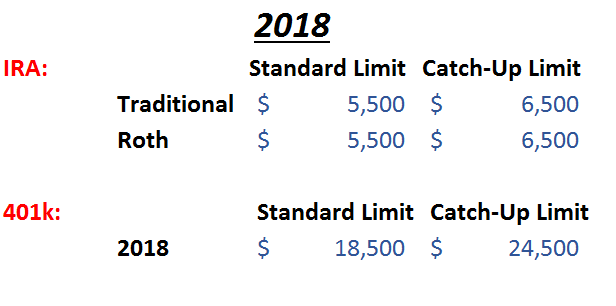

If you can afford it, make the maximum contributions to these accounts each year. For 2018, you are allowed to contribute as much as $18,500 to your 401(k) plan. To do that, you’ll need to set aside $1,541.67 each month. And, if you’re 50 or older, you can contribute up to $24,000, making your monthly contribution $2,000.

Take a look at our chart below to see how much you can contribute to your IRA this year.

By maxing out your contributions to these accounts, you could reap significant rewards. Most importantly, you’ll be on the road towards building wealth for your retirement years. And the tax benefits? Those are icing on the cake.

Everyone’s path to a comfortable, happy retirement is different. And planning for your post-work golden years is a balance. You want to set aside money for later, while you still meet your needs and desires for today. So, my advice is to do the very best you can. Whether it takes you 10, 20, or 40 years to grow your wealth into millions, it will be well worth the time.